Agentic AI & RIA — The Explainable Risk Reasoning Layer

Netra RIA provides a relational reasoning engine that connects entities, transactions, and events into auditable decision logic.

Query (NL Reasoning)

Accepts structured or natural-language questions and translates them into graph-based reasoning steps.

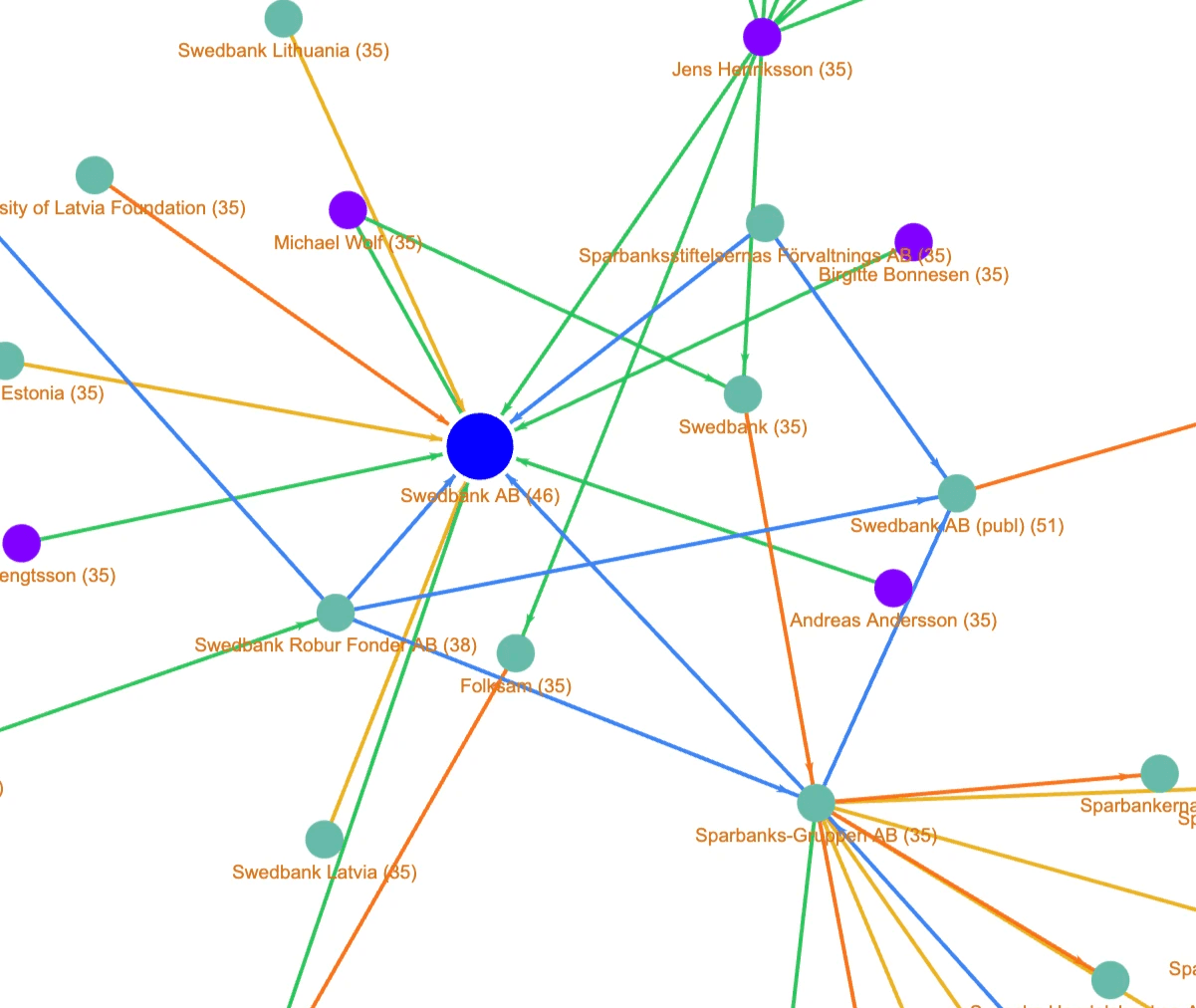

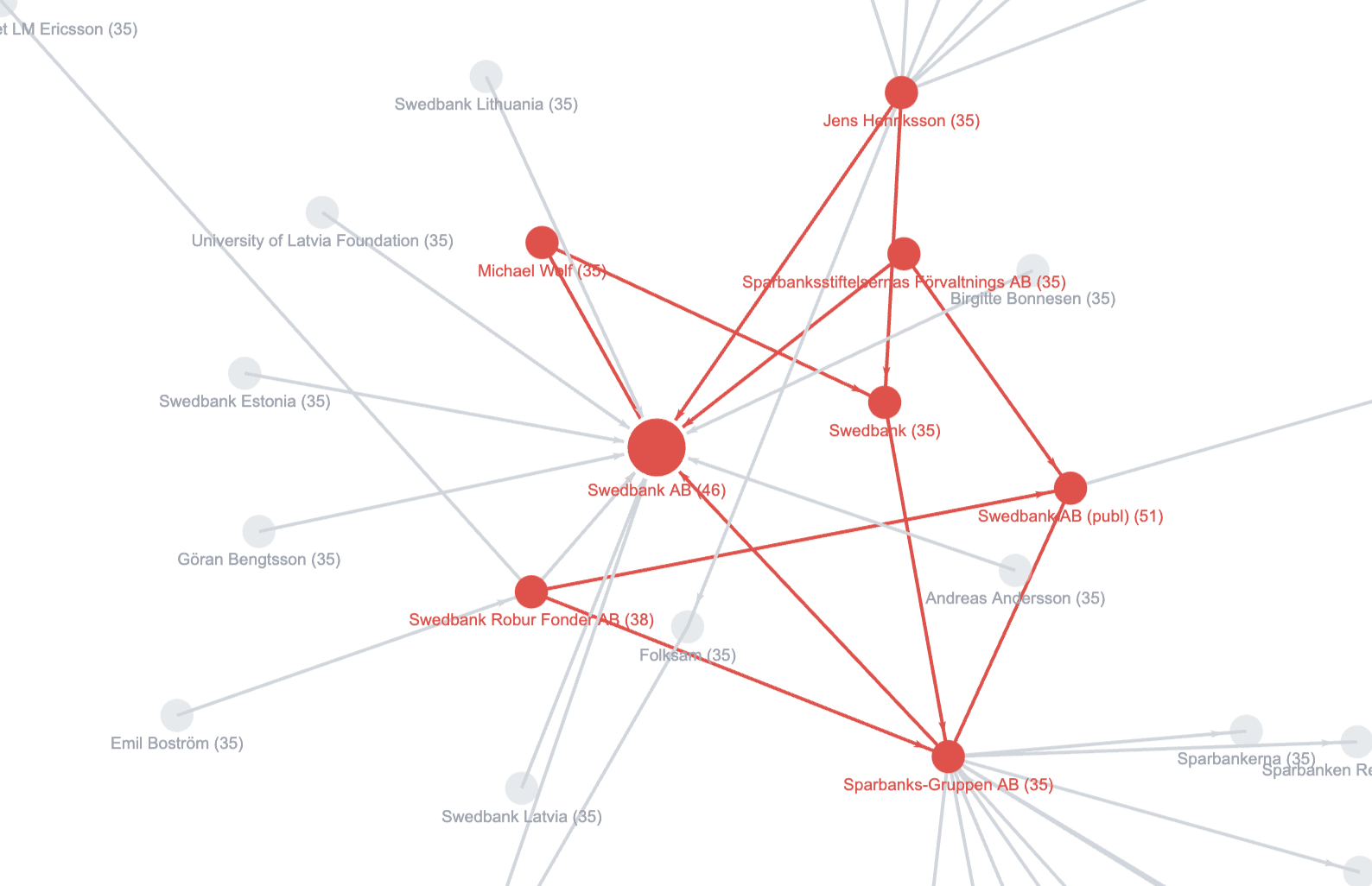

Model (Rel. Mapping)

Builds and maintains relationship graphs across entities, ownership, transactions, and disclosures.

Decide (Trace. Resolution)

Produces conclusions supported by explicit reasoning paths, evidence references, and timestamps.

Every action is logged, explainable, and auditable.

RIA is designed to reduce investigation friction by replacing opaque scoring and

alert logic with explicit, reviewable reasoning.

Faster Investigations

Cycles

through relationship-first analysis

Fast Conclusions

suitable for audit and regulatory review

Human-in-the-loop

workflows where analysts validate, not guess

Proven Outcomes from Explainable Intelligence