Products

Products

Products

Explainable AI for Smarter Compliance

Compliance teams face growing complexity, fragmented data, and opaque automation. Netra brings context, speed, and explainability, turning complex risk signals into decisions teams can understand and trust.

From Data Overload to Explainable Intelligence

Netra’s reasoning agents analyze, connect, and explain risk signals, delivering

clarity where black-box automation leaves teams guessing.

Discover hidden relationships, real-time context, and the why behind every risk signal.

From Manual Checks to Reasoning Engines

Replace static workflows with Netra RIA AI that reasons across entities, ownership, and

disclosures, turning fragmented data into explainable context analysts can act on.

Each Netra RIA agent operates with built-in traceability, reasoning steps are

logged, source-linked, and reviewable for audit and oversight.

From Documents to Defensible Decisions

AI-powered document extraction and graph reasoning transform unstructured

reports into explainable insights, connecting entities, events,

and evidence into a coherent

risk picture.

Start investigating.

White Paper

White Paper

White Paper

Move from Reactive Reviews to Proactive Risk Understanding

Netra integrates into existing onboarding, monitoring, and investigation workflows , adding real-time context and explainability without replacing existing systems.

Why Teams Choose Netra for Explainable Compliance

Netra’s reasoning-first architecture combines graph data, language models, and

audit trails, delivering decisions that are both fast and defensible.

Solution

Netra

Quantexa

Ascent RegTech

WorkFusion

SAS AML

SymphonyAI Sensa

Lucinity

Fenergo CLM

ComplyAdvantage

Trunarrative (LexisNexis)

Hawk AI

Entity Expansion

✓ Contextual NLP

✓ Contextual entity resolution

✓ Regulatory ontology links

◑ Pre-trained models

◑ Rules-based

◑ Risk indicators only

◑ Behavioral entities

◑ Entity profiles

◑ Keyword/entity match

✗ Absent

✗ Absent

Graph Reasoning

✓ Multi-hop analysis

✓ Relationship graphs

◑ Rule graph only

◑ Rules engine

◑ Network graph for risk

✗ Absent

✗ Absent

◑ Risk graph, limited reasoning

✗ No graph reasoning

✗ Absent

✗ Absent

Workflow Assistance

✓ Proactive suggestions

◑ Human-in-loop workflow

◑ Workflow triggers

✓ Workflow automation

✓ Rule-driven alerts

✓ Onboarding workflows

✓ Anomaly-driven triggers

✓ Case collaboration UI

◑ Case management workflows

✓ Case + review workflows

✓ Alert triage workflows

Solution

Netra

Quantexa

Ascent RegTech

WorkFusion

SAS AML

SymphonyAI Sensa

Lucinity

Fenergo CLM

ComplyAdvantage

Trunarrative

Hawk AI

Entity Expansion

✓ Contextual NLP

✓ Contextual resolution

✓ Regulatory ontology links

◑ Pre-trained models

◑ Rules-based

◑ Risk indicators only

◑ Behavioral entities

◑ Entity profiles

◑ Keyword/entity match

✗ Absent

✗ Absent

Graph Reasoning

✓ Multi-hop analysis

✓ Relationship graphs

◑ Rule graph only

◑ Rules engine

⚠ Graph for risk

✗ Absent

✗ Absent

⚠ Limited reasoning

✗ No graph reasoning

✗ Absent

✗ Absent

Workflow Assistance

✓ Proactive suggestions

◑ Human-in-loop workflow

◑ Workflow triggers

✓ Workflow automation

✓ Rule-driven alerts

✓ Onboarding workflows

✓ Anomaly-driven triggers

✓ Case collaboration UI

⚠ Case management

✓ Case + review workflows

✓ Alert triage workflows

The comparison below reflects general capability focus areas based on publicly available information and typical deployments. Actual implementations vary by customer and configuration.

What Makes Netra Different?

What features and capabilities are important in Netra's RIA?

1. Smart Entity Resolution

Connect people, companies, and ownership with relational precision.

2. Network Risk Detection

Reveal hidden ties across jurisdictions and time.

3. Adaptive Risk Analytics

Identify behavioral and structural anomalies with contextual reasoning.

4. Real-Time Explainability

Every output includes the “why” and the evidence behind it.

How Netra Helps

Your Team

Analysts gain speed and clarity. Compliance officers gain audit-ready explanations. Executives gain confidence in how risk decisions are made.

Find quick answers on integrations, security, and compliance readiness.

1. How is the risk score determined, and can it be customised?

Netra’s risk scores are generated through an explainable reasoning engine that combines graph analytics, agentic AI, and rule-based logic. Each score is fully traceable — showing why a decision was made, which data points influenced it, and how the weighting was applied. The framework can be customised to align with your organisation’s internal policies, risk appetite, and regulatory requirements — ensuring transparency without sacrificing flexibility.

2. What data sources does the platform use for screening and information gathering?

Netra integrates with a broad range of global data providers, combining purchased, public, and client-supplied sources. Data is cross-verified where possible to reduce noise and false positives.

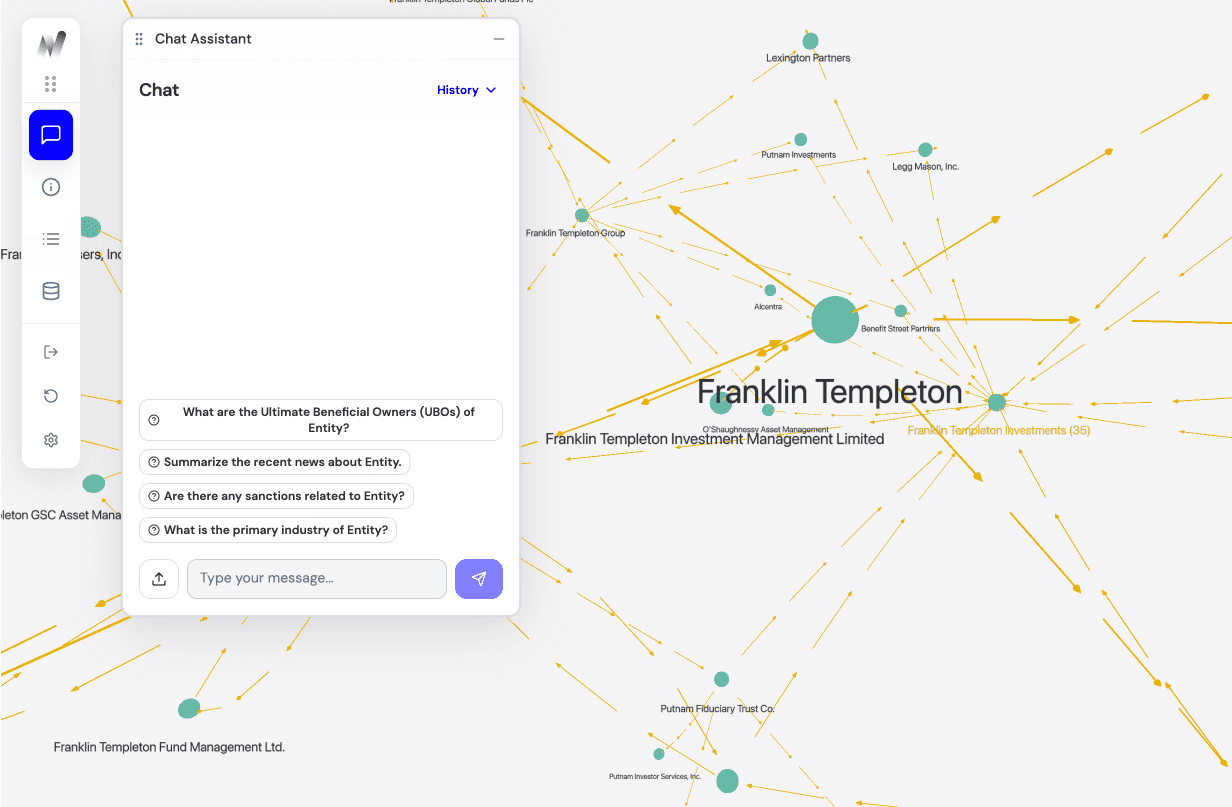

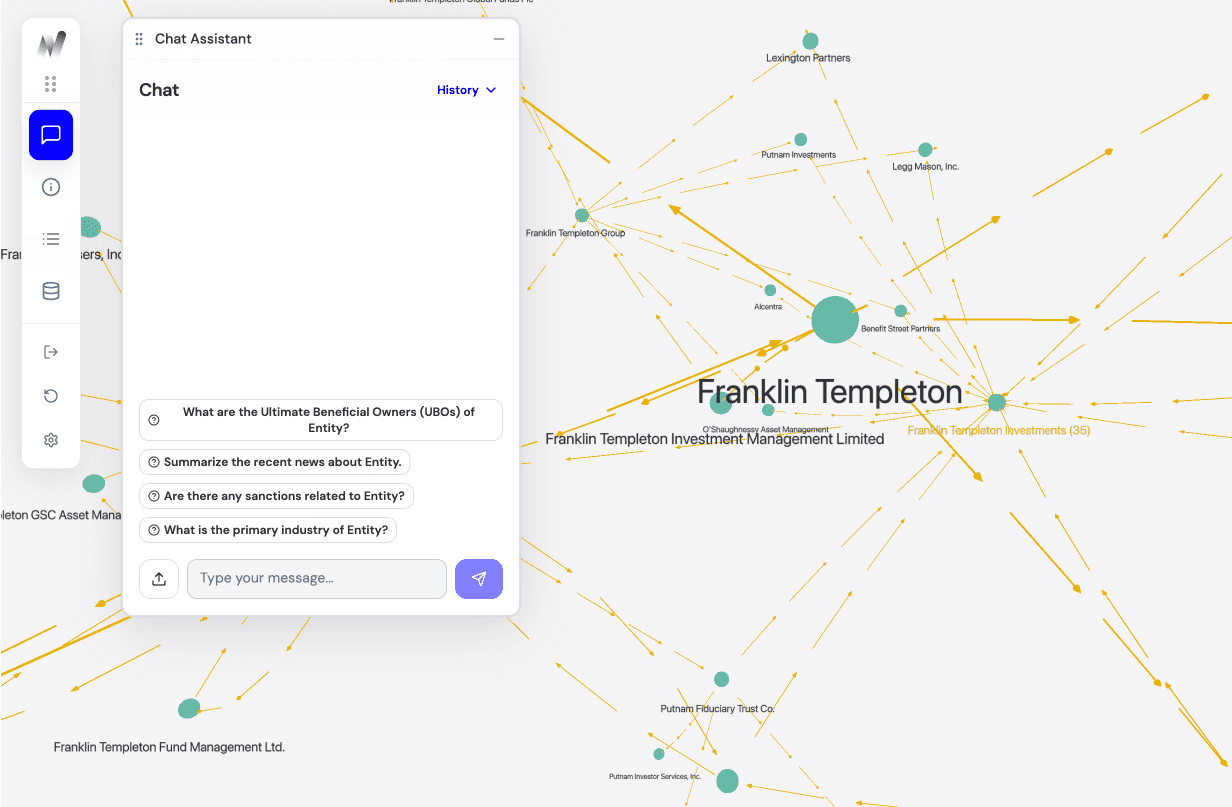

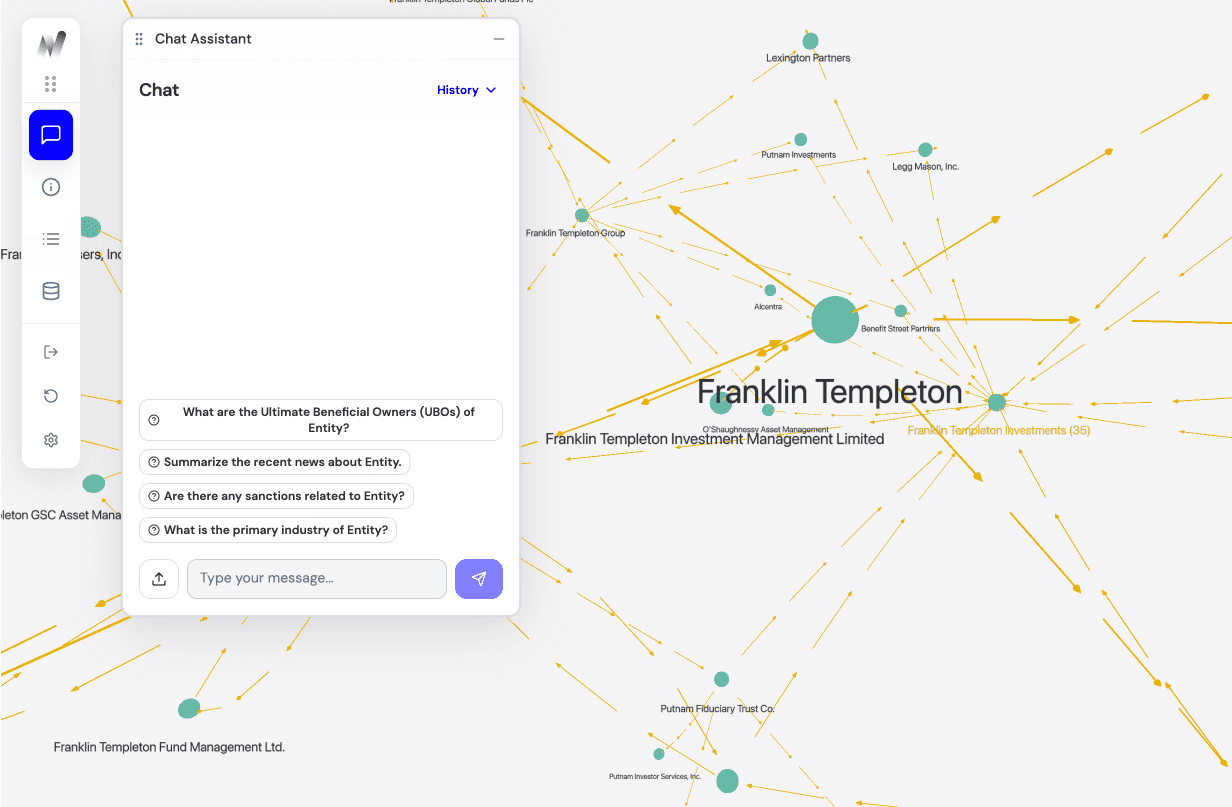

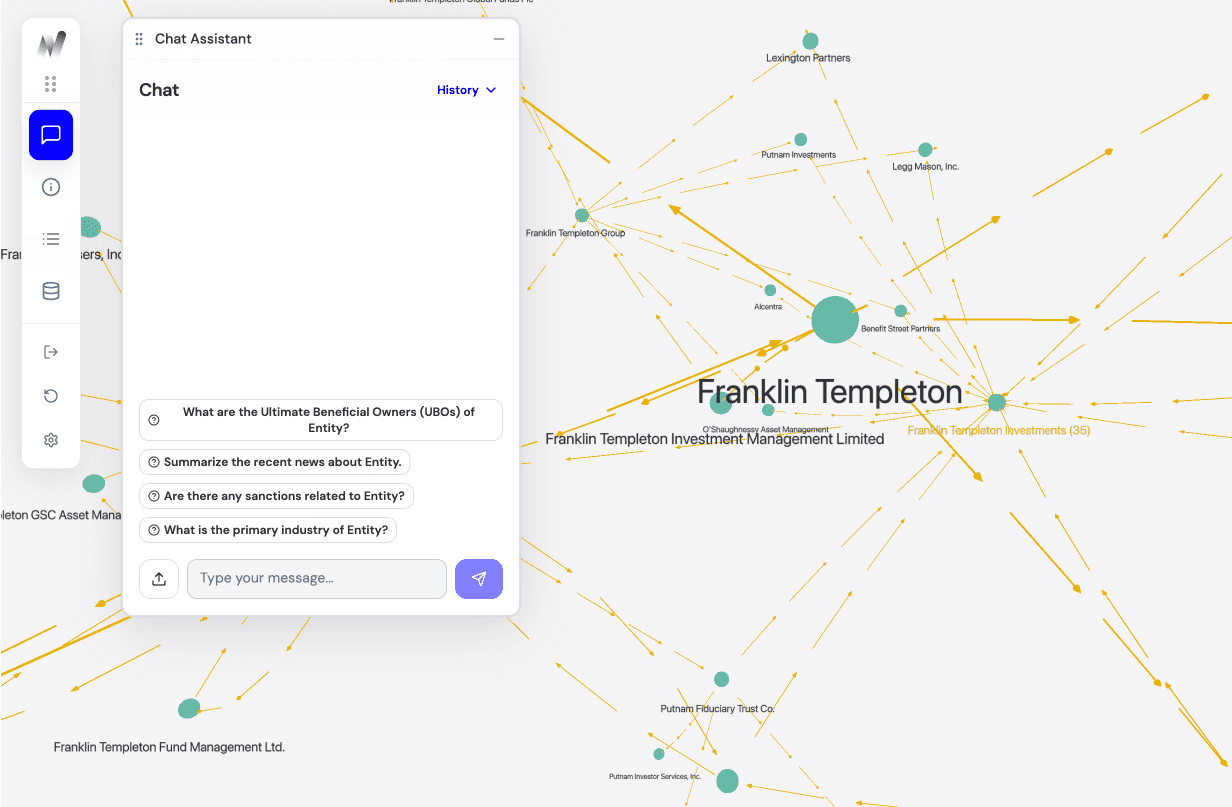

3. What is the value of the visual knowledge graph (ownership tree)?

The visual knowledge graph turns complex ownership data into explainable context. It shows not just who is connected, but how and why — revealing the relationships, timelines, and entities that influence a risk decision. Each node in the graph links back to verified sources, allowing analysts and auditors to trace every conclusion with one click. In short, it transforms compliance from static reports into living, transparent intelligence.

4. Can the platform screen against internal or client-specific lists?

The visual knowledge graph offers an intuitive map of ownership and relational links for the entity under review. It displays layered connections (e.g., shareholders, directors, affiliates) across levels of ownership or influence. Yes. Netra is fully customisable, allowing clients to upload and integrate internal lists—such as blacklists, watchlists, or competitor databases—via bulk uploads (e.g., Excel). These custom datasets are automatically included in risk reviews and screening processes, enabling compliance with internal policies and operational needs.

5. Is the platform API-enabled for integration with other systems?

Absolutely. Netra provides API access to retrieve risk scores, reports, and data points. This enables seamless integration with internal tools such as Customer Lifecycle Management (CLM) platforms, allowing users to access Netra's functionality without leaving their own workflows.

6. How does the platform use Artificial Intelligence (AI) and Large Language Models (LLMs)?

Netra uses AI and LLMs selectively to improve efficiency and usability, including: - summarising key findings - assisting with document review - guiding analysts through complex datasets AI is applied where it adds clarity and speed — while keeping humans in control of final decisions.

1. How is the risk score determined, and can it be customised?

Netra’s risk scores are generated through an explainable reasoning engine that combines graph analytics, agentic AI, and rule-based logic. Each score is fully traceable — showing why a decision was made, which data points influenced it, and how the weighting was applied. The framework can be customised to align with your organisation’s internal policies, risk appetite, and regulatory requirements — ensuring transparency without sacrificing flexibility.

2. What data sources does the platform use for screening and information gathering?

Netra integrates with a broad range of global data providers, combining purchased, public, and client-supplied sources. Data is cross-verified where possible to reduce noise and false positives.

3. What is the value of the visual knowledge graph (ownership tree)?

The visual knowledge graph turns complex ownership data into explainable context. It shows not just who is connected, but how and why — revealing the relationships, timelines, and entities that influence a risk decision. Each node in the graph links back to verified sources, allowing analysts and auditors to trace every conclusion with one click. In short, it transforms compliance from static reports into living, transparent intelligence.

4. Can the platform screen against internal or client-specific lists?

The visual knowledge graph offers an intuitive map of ownership and relational links for the entity under review. It displays layered connections (e.g., shareholders, directors, affiliates) across levels of ownership or influence. Yes. Netra is fully customisable, allowing clients to upload and integrate internal lists—such as blacklists, watchlists, or competitor databases—via bulk uploads (e.g., Excel). These custom datasets are automatically included in risk reviews and screening processes, enabling compliance with internal policies and operational needs.

5. Is the platform API-enabled for integration with other systems?

Absolutely. Netra provides API access to retrieve risk scores, reports, and data points. This enables seamless integration with internal tools such as Customer Lifecycle Management (CLM) platforms, allowing users to access Netra's functionality without leaving their own workflows.

6. How does the platform use Artificial Intelligence (AI) and Large Language Models (LLMs)?

Netra uses AI and LLMs selectively to improve efficiency and usability, including: - summarising key findings - assisting with document review - guiding analysts through complex datasets AI is applied where it adds clarity and speed — while keeping humans in control of final decisions.

1. How is the risk score determined, and can it be customised?

Netra’s risk scores are generated through an explainable reasoning engine that combines graph analytics, agentic AI, and rule-based logic. Each score is fully traceable — showing why a decision was made, which data points influenced it, and how the weighting was applied. The framework can be customised to align with your organisation’s internal policies, risk appetite, and regulatory requirements — ensuring transparency without sacrificing flexibility.

2. What data sources does the platform use for screening and information gathering?

Netra integrates with a broad range of global data providers, combining purchased, public, and client-supplied sources. Data is cross-verified where possible to reduce noise and false positives.

3. What is the value of the visual knowledge graph (ownership tree)?

The visual knowledge graph turns complex ownership data into explainable context. It shows not just who is connected, but how and why — revealing the relationships, timelines, and entities that influence a risk decision. Each node in the graph links back to verified sources, allowing analysts and auditors to trace every conclusion with one click. In short, it transforms compliance from static reports into living, transparent intelligence.

4. Can the platform screen against internal or client-specific lists?

The visual knowledge graph offers an intuitive map of ownership and relational links for the entity under review. It displays layered connections (e.g., shareholders, directors, affiliates) across levels of ownership or influence. Yes. Netra is fully customisable, allowing clients to upload and integrate internal lists—such as blacklists, watchlists, or competitor databases—via bulk uploads (e.g., Excel). These custom datasets are automatically included in risk reviews and screening processes, enabling compliance with internal policies and operational needs.

5. Is the platform API-enabled for integration with other systems?

Absolutely. Netra provides API access to retrieve risk scores, reports, and data points. This enables seamless integration with internal tools such as Customer Lifecycle Management (CLM) platforms, allowing users to access Netra's functionality without leaving their own workflows.

6. How does the platform use Artificial Intelligence (AI) and Large Language Models (LLMs)?

Netra uses AI and LLMs selectively to improve efficiency and usability, including: - summarising key findings - assisting with document review - guiding analysts through complex datasets AI is applied where it adds clarity and speed — while keeping humans in control of final decisions.

1. How is the risk score determined, and can it be customised?

Netra’s risk scores are generated through an explainable reasoning engine that combines graph analytics, agentic AI, and rule-based logic. Each score is fully traceable — showing why a decision was made, which data points influenced it, and how the weighting was applied. The framework can be customised to align with your organisation’s internal policies, risk appetite, and regulatory requirements — ensuring transparency without sacrificing flexibility.

2. What data sources does the platform use for screening and information gathering?

Netra integrates with a broad range of global data providers, combining purchased, public, and client-supplied sources. Data is cross-verified where possible to reduce noise and false positives.

3. What is the value of the visual knowledge graph (ownership tree)?

The visual knowledge graph turns complex ownership data into explainable context. It shows not just who is connected, but how and why — revealing the relationships, timelines, and entities that influence a risk decision. Each node in the graph links back to verified sources, allowing analysts and auditors to trace every conclusion with one click. In short, it transforms compliance from static reports into living, transparent intelligence.

4. Can the platform screen against internal or client-specific lists?

The visual knowledge graph offers an intuitive map of ownership and relational links for the entity under review. It displays layered connections (e.g., shareholders, directors, affiliates) across levels of ownership or influence. Yes. Netra is fully customisable, allowing clients to upload and integrate internal lists—such as blacklists, watchlists, or competitor databases—via bulk uploads (e.g., Excel). These custom datasets are automatically included in risk reviews and screening processes, enabling compliance with internal policies and operational needs.

5. Is the platform API-enabled for integration with other systems?

Absolutely. Netra provides API access to retrieve risk scores, reports, and data points. This enables seamless integration with internal tools such as Customer Lifecycle Management (CLM) platforms, allowing users to access Netra's functionality without leaving their own workflows.

6. How does the platform use Artificial Intelligence (AI) and Large Language Models (LLMs)?

Netra uses AI and LLMs selectively to improve efficiency and usability, including: - summarising key findings - assisting with document review - guiding analysts through complex datasets AI is applied where it adds clarity and speed — while keeping humans in control of final decisions.